Understand your WorkPlace Cover invoice (for shareholder-employees)

If you have received a WorkPlace Cover invoice from us, we explain the key sections below. This is cover for your shareholder-employees.

On this page

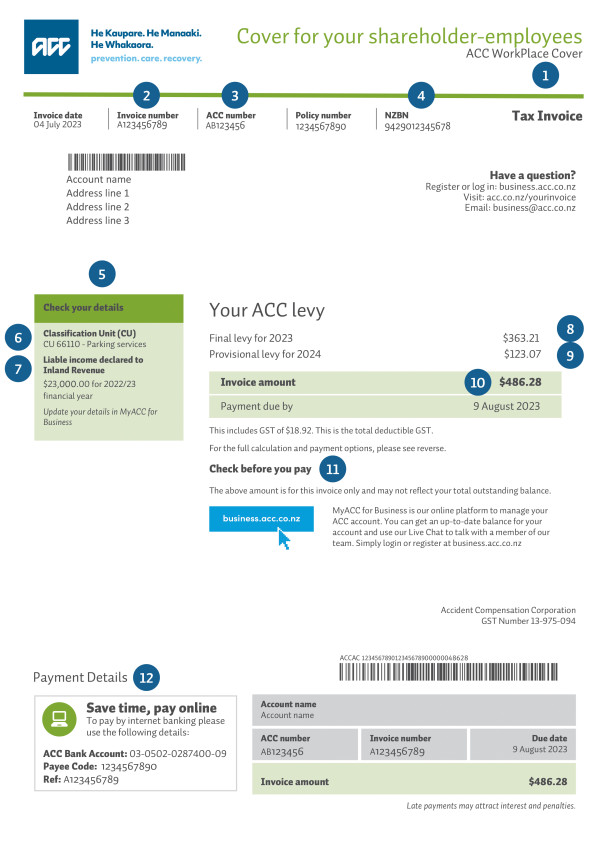

Invoice (front page)

- WorkPlace cover - WorkPlace Cover is our standard cover for all employers. It provides cover for your employees' rehabilitation and weekly compensation after an injury. Standard cover for employers

- Invoice number - the is the unique identifier for your invoice. Have this ready if you need to contact us.

- ACC number - this is the unique identifier for your business. Have it ready if you need to contact us.

- New Zealand Business Number (NZBN) - this is a globally unique identifier for your business. Search for your NZBN.

- Key information box - this box outlines the information we used to calculate your levy. It is important that we have the correct information, as it affects the amount you pay us. Contact us if any of this information is wrong.

- Classification Unit (CU) - this is a description of your business activity. This is based on your Business Industry Classification (BIC) code. Find your BIC code

- Liable payroll - we base this on the payroll information you declared to Inland Revenue on the IR348 Employer monthly schedule, along with deductions made by ACC.

- Final levy - this levy is for the year end, or ‘wash up’ for the previous year, and is based on the earnings details we’ve received from Inland Revenue.

- Provisional levy - this is the estimate invoice based on your payroll for the previous year and is adjusted for expected salary increases.

- Invoice amount - the total you need to pay. This doesn't include any outstanding amounts that may be on your account already.

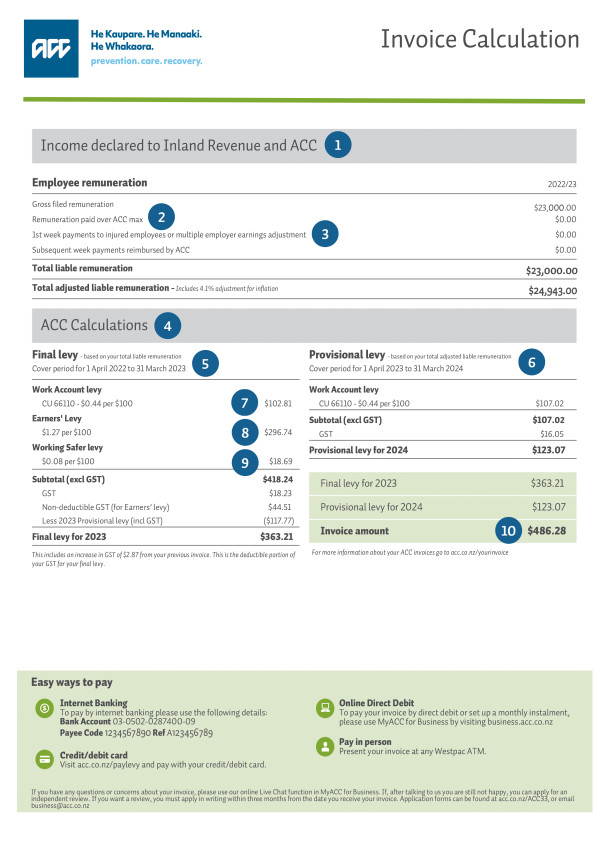

Calculations (back page)

- Payroll declared to Inland Revenue - this section shows the employee payroll information that we’ve received from Inland Revenue.

- Payroll paid over the ACC max - when a employee earns more than a maximum liable income level from the employer, ACC does not levy any additional income earned.

- First week payments or multiple employer earnings adjustments - if an employer paid an employee’s first week of weekly compensation from a workplace accident, or an employee earned above the maximum liable income level across different income sources, the employer can contact ACC to adjust the income used to calculate their levy.

- Liable payroll- we base this on the payroll information the employer declared to Inland Revenue on the IR348 Employer monthly schedule.

- ACC calculations - this section shows how we calculate your provisional and final levies.

- Final levy- this levy is for the year end, or ‘wash up’ for the previous year, and is based on the earnings details we’ve received from Inland Revenue.

- Work Account levy - standard levy paid by employers and people who are self-employed. We calculate this on every $100 of your liable payroll and your Classification Unit (CU).

- Working Safer levy - this levy is collected on behalf of WorkSafe New Zealand and is a fixed rate per $100 earned for every levy payer in New Zealand.

- Provisional levy - this is the estimate invoice based on your payroll for the previous year and is adjusted for expected salary increases.

- Total amount to pay - the total of your final levy and your provisional levy that you need to pay. This doesn't include any outstanding amounts that may be on your account already.

Last published: 22 September 2025