Understand your CoverPlus invoice

If you've received a CoverPlus invoice from us, we explain the key sections below.

On this page

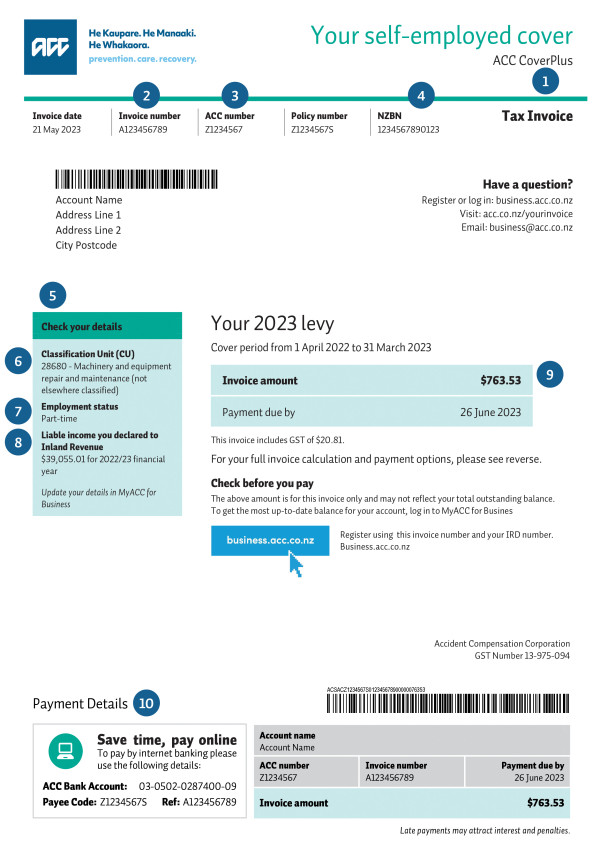

Invoice (front page)

- ACC CoverPlus - this is our standard cover if you are self-employed, have an accident and can't work. You are automatically be placed on CoverPlus when you start self-employment.

- Invoice number - the is the unique identifier for your invoice. Have this ready if you need to contact us.

- ACC number - this is the unique identifier for your business. Have it ready if you need to contact us.

- New Zealand Business Number (NZBN) - this is a globally unique identifier for your business. Search for your NZBN.

- Key information box - this box outlines the information we used to calculate your levy. It is important that we have the correct information, as it affects the amount you pay us. Contact us if any of this information is wrong.

- Classification Unit (CU) - this is a description of your business activity. This is based on your Business Industry Classification (BIC) code. Find your BIC code

- Employment status - this shows that you either work full-time or part-time. This may affect much you have to pay in levies. You're classified as full-time if you work more than 30 hours per week from all sources of employment.

- Liable income - we base this on the income you declared to Inland Revenue on your tax return. This is either your IR3 Individual income return or IR7 Partnerships and look through companies (LTCs).

- Invoice amount - the total you need to pay. This doesn't include any outstanding amounts that may be on your account already.

- Payment schedule - If you’ve already set up a payment schedule with us, these will be your payment dates. You don’t need to do anything. Find out about other ways you can pay your invoice: Ways to pay your levies

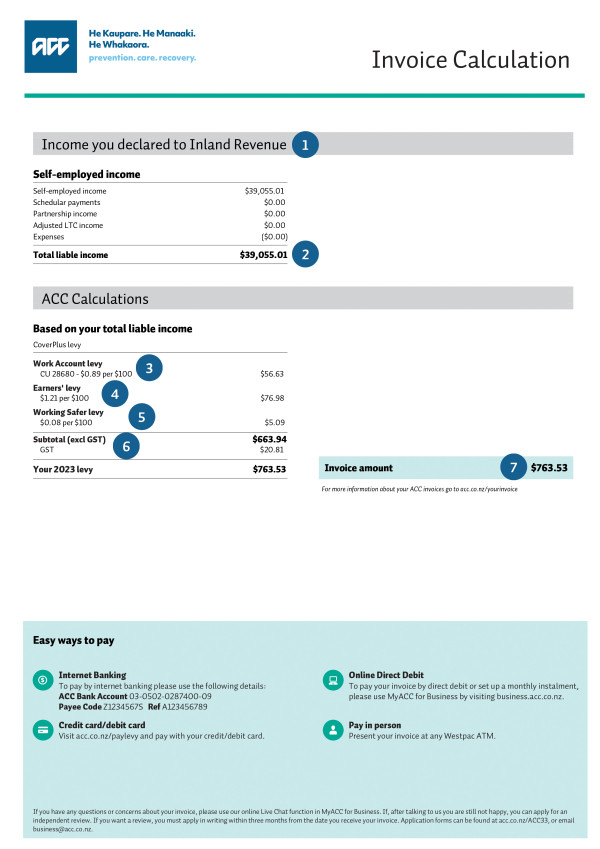

Calculations (back page)

- Income you declared to Inland Revenue - this section shows the self-employed earnings information that we’ve received from Inland Revenue.

- Liable income - we base this on the income you declared to Inland Revenue on your tax return. This is either your IR3 Individual income return or IR7 Partnerships and look through companies (LTCs).

- Work Account levy - standard levy paid by employers and people who are self-employed. We calculate this on every $100 of your liable income and your Classification Unit (CU).

- Earners' levy - this levy covers the current and future cost of non-work-related injuries to self-employed people.

- Working Safer levy - this levy is collected on behalf of WorkSafe New Zealand and is a fixed rate per $100 earned for every levy payer in New Zealand.

- GST - the amount of deductible GST included on the invoice.

- Invoice amount - the total you need to pay. This doesn't include any outstanding amounts that may be on your account already.

Last published: 22 September 2025